Fixed asset audits also determine if your company is experiencing inordinate shrinkage.

If losses form a pattern and are consistent across all assets, evaluating how your assets are assigned, moved, or stored should identify the weakness within your company’s asset management procedures, allowing you to address and correct those procedural gaps before your losses become too severe.

The fixed asset audit procedures are for those assets that are expected to last more than just a year such as land, buildings, assets, and equipment. Fixed assets are primary resources for the business. Asset audit is necessary to do once a year to update all the records of assets in a proper manner.

What Are the Benefits of Asset Auditing?

Some of the benefits of asset auditing:

Depreciation Management

The value of the asset decreases time after time that is depreciation. Every fixed asset has its own depreciation rate. Depreciation provides the way to the company to distribute the cost of an asset according to the useful life of the asset.

In order to calculate accurate asset depreciation, there are two methods written down value and the straight-line method.

Get Rid of Ghost Assets

Ignorance can be harmful to the business. As a good business practice, one should always emphasize on asset tracking. With the help of this practice, ghost assets will not harm your business. Ghost assets are those assets which are physically not available but they are accounted in records. As a result, you end you paying taxes for those assets which you are not own. But with auditing, you can identify and get rid of ghost assets.

Regulatory Compliance

When an external audit is conducted and if it is found that you are using unauthorized software, the auditor can penalize the organization for a huge amount of money. This is also an example of a compliance breach. Therefore, it is very important to maintain compliance. In order to ensure compliance, audits are really helpful. When an asset is used for another purpose rather than what it is intended towards, then it is considered as an indicator of a compliance violation.

What Are the Features of Asset Management Software That Can Assist in Auditing?

Below we have mentioned the features of asset management software that can assist in asset auditing:

- If an organization has multiple branches then obviously there are assets located on multiple locations so the software empowers the user to create and assign audits as per the asset’s location and their categories.

- The audit objective is to save assets from damage, theft misplacement.

- You can physically verify assets quickly via the mobile application and the best part is the verification can be done offline. Whenever the mobile gets connected to the internet, the collected information is synchronized.

- During the audit, the status can be seen as if an asset in present, not present or present with incorrect data like tagged asset is not the same what system has specified.

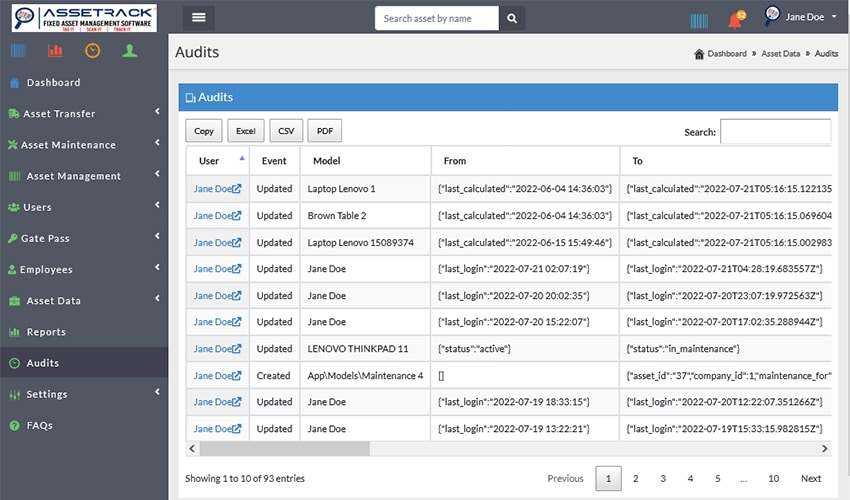

- Asset reports are automatically generated and it can be exported in various formats. It also empowers the user to get customized data report as per requirement.

- Users can assign a unique set of assets so that no data collision occurs and confusion can be avoided.

- There is a depreciation calculation program which offers different methods to calculate depreciation while generating reports.

The audit objective is to keep accurate asset information. Hence, auditing is an exceptionally critical process for your business. Deployment of an asset tracking system that also provides ease during the asset auditing process, along with a complete audit report, will help an organization grow and run smoothly.